N44cs Funding LLC

"Captial Sourcing Is Our Mission"

WELCOME!

"Capital Sourcing Is Our Mission"

N44 CS Funding – Capital Sourcing Is Our Mission

At N44 CS Funding, we specialize in private hard money lending for real estate investors. Whether you're wholesaling, rehabbing, or building a rental portfolio, we make funding fast, flexible, and hassle-free – so you can focus on growing your investments.

As an equity-based lender, we look at the value of your property, not your credit history. That means quicker approvals and deals that fit your goals.

Capital Sourcing Is Our Mission

– and we’re here to help you fund smarter and invest with confidence.

ABOUT US

Your Trusted Partner in Private Money Lending

At N44 CS Funding, we’re a veteran-owned company built on

mission, integrity, and honor. We specialize in asset-based hard money loans for real estate investors, offering fast, flexible funding for non-owner occupied residential and commercial projects. Our client-first approach means we work closely with you to find the

right loan for your specific project. Whether you need guidance, tailored solutions, or ongoing support —

YOUR SUCCESS IS OUR MISSION

OUR SERVICES

High Quality Services

Flexible Fix and Flip Financing Built for Real Estate Investors

At N44 CS Funding, we offer fix and flip loan solutions tailored to both experienced investors and those just getting started. Whether you're acquiring your first property or scaling your portfolio, our short-term financing options are designed to help you move fast, renovate efficiently, and sell for profit — without the delays of traditional lending. Our fix and flip loans are asset-based and feature flexible terms, making it easier to secure funding based on the property’s value and potential. We also offer financing that can

cover up to 100% of renovation costs , so you can complete your project with confidence and without the need for multiple funding sources. Let us help you find the right loan for your next fix and flip project

— and turn your viFAQsion into a profitable reality.

Fix And Flip Loan Criteria

Tier A

% Of Purchase [90]

% Of Rehab [100]

% Of Max ARV [75]

% Of Max LTC [90]

Experience [2 Deals/2 Yrs]

Credit Score [720+]

Cashout [65% - no max] (6 mo seasoning)

FHA Cap [Loan Amoun]t

Baseline Inspection [No ]

Tax Returns [No]

Well/Septic [No]

Impound Next Yrs Taxes [No]

Tier B

% Of Purchase [90]

% Of Rehab [100]

% Of Max ARV [70]

% Of Max LTC [90]

Experience [2 Deals/2 Yrs 2]

Credit Score [660-719]

Cashout [60% - 150k max] (6 mo seasoning)

FHA Cap [Loan Amount]

Baseline Inspection[ No]

Tax Returns [No]

Well/Septic [No]

Impound Next Yrs Taxes Yrs [No]

Tier C

% Of Purchase [90]

% Of Rehab [100]

% Of Max ARV [65]

% Of Max LTC [90]

Experience [1st Timers Only]

Credit Score [No Minimum]

Cashout {50% - 75k max} (no seasoning)

FHA Cap [ARV]

Baseline Inspection [Yes]

Tax Returns [Yes]

Well/Septic [Yes]

Impound Next Yrs Taxes [Yes}

Scale Your Rental Portfolio with Confidence

At N44 CS Funding, we offer long-term rental property loans designed for real estate investors focused on building wealth through non-owner occupied buy-and-hold properties. Whether you're experienced or just getting started, we provide flexible terms, fast approvals, and custom financing to help you scale without the roadblocks of traditional lending.

Long Term Rental Loan Criteria

For Investment Rental Property Non-Owner Occupied, SFR, 2-4 Units, Condos, PUDs, Townhomes

Minimum Loan Amount [ $100,000 ]

Interest Rate [Starting at 6.5%]

Originations Points [Starting at 1.5%]

Loan Parameters [With attractive rates and up to 80% LTV Purchase & Refinances and up

to 75% LTV Cash-Outs, these rental loans are a great way to grow your

long-term buy and hold properties]

Evaluation [Full Appraisal]

Minimum Credit Score [660]

Included States [All States except ND, UT, VT]

Loan Program [30 Year Fixed at 6.5% Interest]

Properties [- Number of Properties Allowed: 1]

[- DSCR Requirement 0.75]

[-Loan Amount $100K - 2MM]

Bridge the Gap with Fast, Reliable Funding

At N44 CS Funding, our bridge loans give real estate investors the short-term capital they need to act fast — whether it's securing a new property or funding renovations while waiting on another sale. These loans are ideal for time-sensitive deals where traditional financing simply can’t keep up. As a veteran-owned company, we understand the value of speed, precision, and trust. That’s why our bridge loans come with quick approvals, flexible terms, and personalized support , so you can move confidently from one investment to the next. Let us help you bridge the gap — and keep your projects moving forward.

FAQ

Bridge Loans- Jumbo Criteria

Max Allowed (with excess first loss):

-Max 90% (LTV "As is")

-90% (LTC)

-75% (LTV "As Repaired") with approval

Max 12 month loans

Minimum 620 FICO

Up to 90% LTV on as is and up to 75% ARV

Minimum loan amount $50,000 max $2.0 million

Flexible Commercial Real Estate Financing

At N44 CS Funding, we offer commercial real estate loans designed for investors looking to finance office buildings, retail spaces, industrial properties, multifamily units, and more. These loans are built around the unique needs of commercial projects — not one-size-fits-all mortgage standards. Whether your deal is large or small, we provide custom financing solutions tailored to your project’s scope, backed by quick turnarounds and expert guidance. As a veteran-owned lender, we bring mission, integrity, and honor to every client relationship — helping you secure the right funding to meet your investment goals with clarity and confidence.FAQ

Commercial Loan Criteria

KEY FEATURES

Loan amounts up to 7.5MM

Up to 85% LTV

Nationwide financing

First-time investors in commercial are welcome

Min. FICO 660

Great for qualifying self-employed investors and small business owners

PROPERTY TYPES

Apartment Complexes

Multi-family Mixed use (Residential in nature)

And more

Smart Construction Loans for Investment Projects

At N44 CS Funding, we provide construction loans for non-owner occupied single-family homes, condos, and townhomes — helping real estate investors fund new builds or major renovations with confidence. Our loans are tailored to cover both land acquisition and construction costs, giving you the capital you need to bring your investment project to life. With competitive rates, flexible terms, and a focus on speed and service, we ensure you stay on track from start to finish.

Construction Loan Criteria

LOAN CRITERIA

Collateral: Non-Owner Occupied Single-Family Properties; Condos; Townhomes

Rates: Starting at 11.29%

Term: 12 Months to 24 Months

Loan Amount: 100K* – $3M Based on Loan Amount

Minimum Property Value: $150K* **As-Completed Value

Credit Score: 650 Minimum

Max Allowed loan Amount: As is - up to 75%

ARV: up to 85%

Leverage based on experience - Documented experience in the past three years

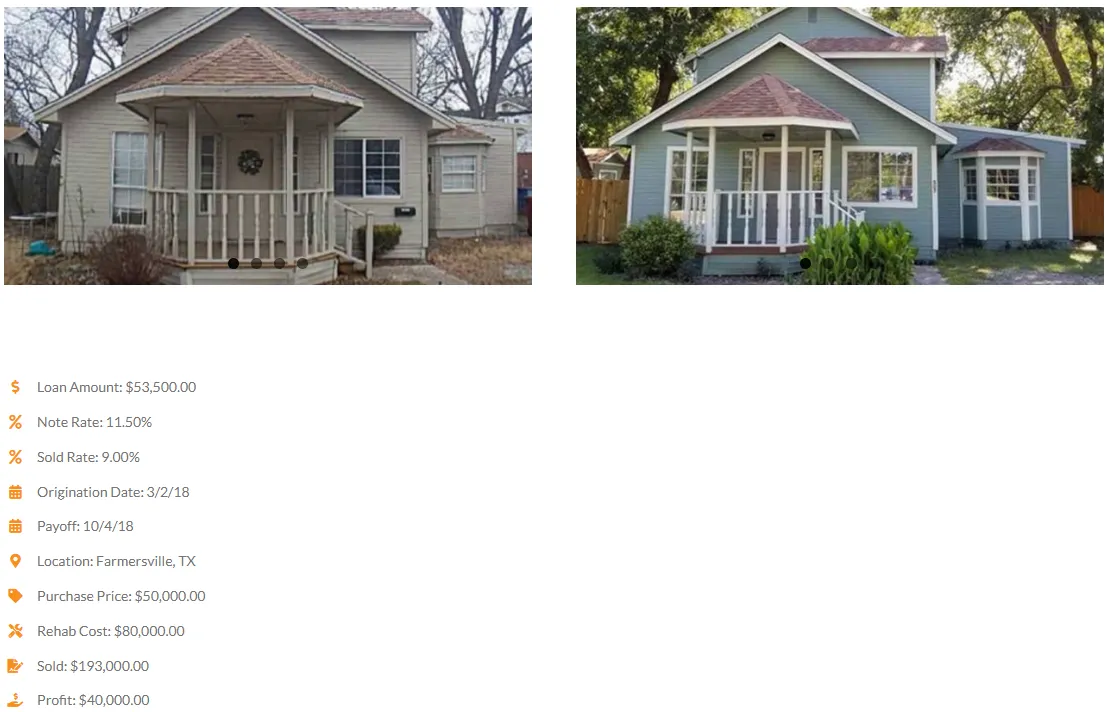

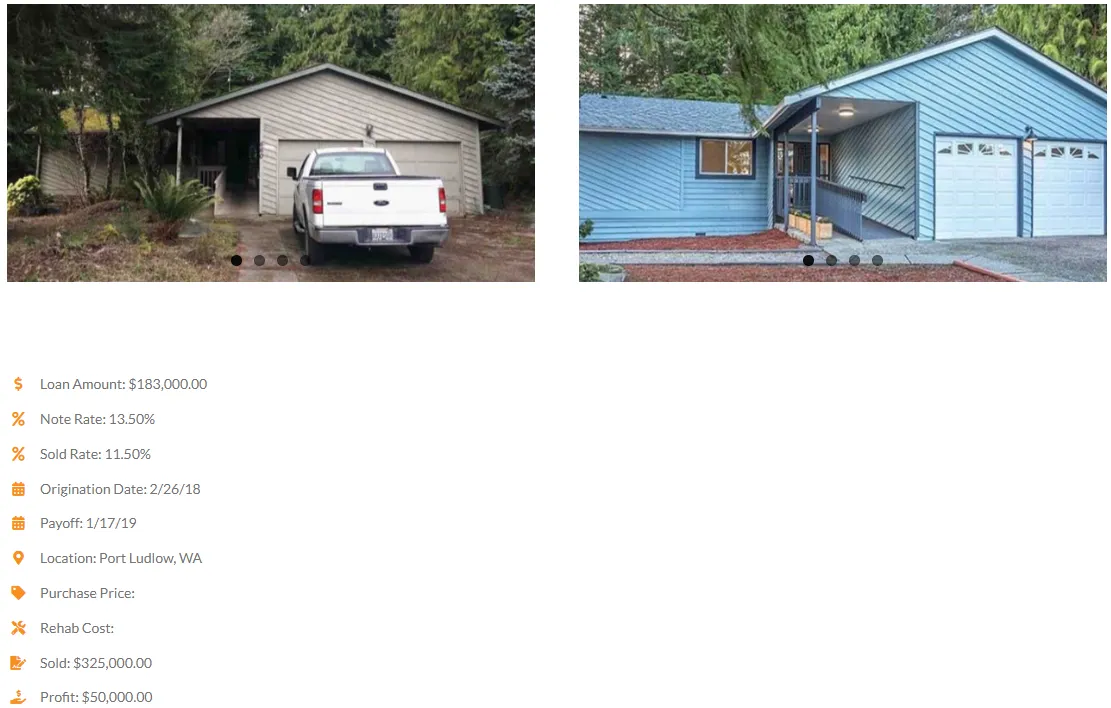

Some Of Our Deals

Farmersville, Tx

Port Ludlow, Wa

FAQS

Can I Use My Free And Clear Property To Fund Non-Owner Occupied Investment?

Yes! It may be used as cross-collateral or used for a cash-out refinance. That is a great strategy! If you have properties that are completely paid for with no liens against them, we can do a cash-out refinance to provide funds for other non-owner occupied investments. You can also use them as cross-collateral for your real estate investing. We use both your subject property and your free and clear property as security for the loan. In doing that, we can lend up to 65% of the as-is combined value of the two properties. That is often enough to purchase your subject property and rehab it. If you have free and clear properties, mention that on your next deal!

How Does N44cs Funding Decide How Much To Lean?

Our decision is based on the property, the type of transaction, and your membership in any of our special programs. For most transactions we will lend up to 90% of the purchase price or 65% of the as-is or after-repair appraised value, whichever is less. Ask a loan officer about the special terms available through our membership programs and special purpose loans.

I Need 100% Financing. Can You Do That?

Yes! Ask a loan officer for more details. If you provide more than one property as security (as described above in regard to cross-collateral) we can provide 100% financing. If you don’t have free and clear property, find a partner that does! Sharing half of a nice profit beats not being able to do the deal! Many of our investors also use seller-carryback to do the same thing. We recommend finding deals and purchasing property below appraised value as the best way to secure 100% financing.

Will You Lend For Both The Purchase And The Repairs?

Yes, for the right deals. If the numbers work and we think the deal will be profitable, we will loan on the After Repair Value (ARV). We recommend you have solid experience doing or managing such repair work. You will need to supply licensed contractor bids as well as meet certain other requirements. Bring us the deal and let’s discuss it.

I Want To Borrow Money Based On The ARV Of The Investment Property I'm Purchasing Or Own. Is This Something You Allow?

Yes! We love flippers! If the deal makes sense, we will help you get it done. Speak to a loan officer for more details.

Why Do I Need To Buy An Appraisal When I Already Have A CMA Or Existing Appraisal?

N44cs Funding requires a recent (less than 90 days old), independent, standards-based, third party, as-is evaluation of every property used as security. BPOs, CMAs, or outside appraisals do not generally satisfy all those requirements. Your best bet: Go with ours. They are performed by local appraisers in your market, working at competitive rates, and doing the appraisal the way we need it to be done. The appraisal report will come to us and you will receive a copy.

What Are Your Rates And Loan Origination Fees?

Our loans are asset-based and our decisions are logic-based. That means we base our decisions about funding and rates on the perceived risk associated with the property. If you have a property under contract, submit it. Our rates are competitive in the private money market but we save our best rates for our best clients. Get started today to become one of those repeat, best clients! Get a property under contract and submit it!

Why Won't You Lend On Owner-Occupied Properties?

Legal and regulatory reasons. Our current business model is to provide bridge loans to real estate investors for terms ranging from three to 24 months. As a result, it is not cost-effective for us to implement the complex and restrictive processes and rules required by regulatory agencies to do business with owner-occupants.

Is Credit The Deciding Factor In N44cs's Decision?

No. Our loans are asset-based. We base our loans on the value of the asset, not on your credit score, income, or the size of your debts. However, a high credit score can potentially get you our better rates.

How Long Does It Take To Close A Transaction From Start To Finish?

Three to four days after we receive all required documentation, which can often take three to four weeks. Though we can do it faster, a good estimate would be three to four weeks after we receive the basic application package. The key factor is the amount of time it takes you and your team to supply all the supporting documentation. We can do our part in 3-4 days, but first-time borrowers rarely get us the documents quickly enough and complete enough to meet that. Go for 30 days or more whenever you can. Remember: if time to close is a factor, you probably have competition. Competition does not usually translate into a good deal. Forget such a deal and go find a good one! (Admittedly, sometimes other factors dictate closing time. If that’s the case, bring us the deal and let’s discuss it!)

The first Private Money loan with N44. My first transaction with N44cs Funding went well. We were able to get the deal funded and closed in under 30 days. Many thanks to the team at N44 for making it happen!!!

Clyde W. California

Plain and simple! The most professional and accessible service ever! Thanks,

N44 for being there for us the real estate entrepreneurs!

Salvador Perez

The entire process was positive from start to closed. Some deals close with little or no issues. Some have a way of not wanting to close. The team at

N44 took the time and worked with seller, buyer, attorneys, and Title company to make my deal work! Thank you for all your hard work, patience, and effort.

Gerard Buijck

My first loan with N44 and my loan officer Terri was there every step. I would call her with any and every question that came to mind and she would gladly answer and if she couldn’t she would get back to me with an answer. On to the next closing.

Dee

OUR TESTIMONIALS

Client's Feedbacks

I just completed my first flip loan with N44 and I have to say, their team was awesome to work with. None of my questions went unanswered, and they guided me through the process. Communications were 100% and I am a great appreciator of that! If you’re looking for the answer to “Where am I going to get the money?” then N44 is the place to get it!

Laurie Ironside-Wall

“Good loans for fix and flip opportunities. Also good educational and training programs.”

Manny Ramilo

“I had a wonderful experience working with N44. My loan officer Bill was amazing to deal with. He was always very prompt with communications and the whole deal went extremely smooth from start to finish. I deal with a lot of lenders and this was one of the best transactions I’ve ever completed so I had to write them a great review. Everything was simple and they delivered on what they promised. I’ve already referred to several other investors and N44 is my new go to lender for all deals.”

James Crosby